Nov 30, 2025

Melbourne's best performing suburbs over the past 30 years

Melbourne's best performing suburbs over the past 30 years: Suburb SA4 region 30-year price growth factor Current dwelling AVM Blairgowrie Mornington Peninsula 13.2 $1,279,

Oct 9, 2025

Melbourne Real Estate Insights: What’s Driving the Market in Late 2025

Stay informed with the latest trends and insights shaping Melbourne’s property market — helping you make confident and well-informed real estate decisions. Sales & Prices Dwelling va

Oct 6, 2025

September Quarter 2025 Median Prices

Quarterly median data for the period ending 30 September 2025 released today by the Real Estate Institute of Victoria (REIV) shows that house prices climbed 2.7 per cent and 2.5 per cent in metropolit

Sep 11, 2025

August Quarter 2025 Median Prices

August Quarter 2025 Median Prices Australia Wide Comparisons (information sourced from cotality) Median House Prices - Houses Median Rents - Houses Median Sale Price Change (1 yr) -

Jul 22, 2025

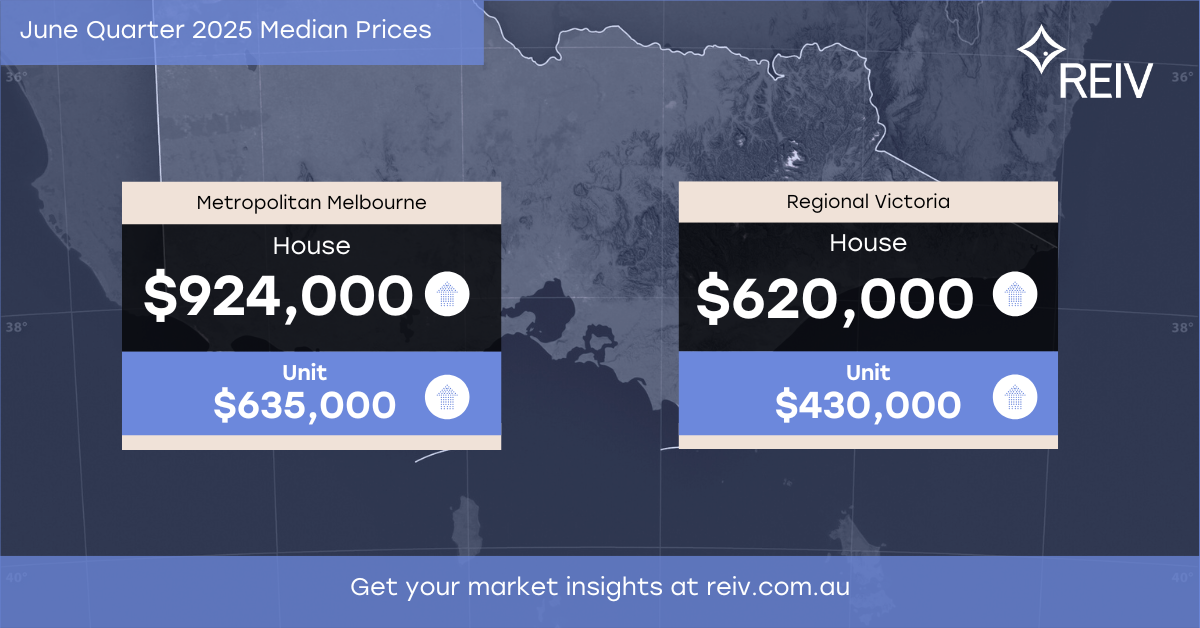

June Quarter 2025 Median Prices

Rising optimism as Victoria sees second consecutive quarter of property price growth Quarterly median data from the Real Estate Institute of Victoria (REIV) has shown that in the three-month

Apr 7, 2025

March Quarter 2025 Median Prices

March Quarter 2025 Median Prices Positive quarterly house price results reflect ongoing stabilisation of diverse Victorian property market The median house price rallied in metropolitan and

Apr 15, 2024

March Quarter 2024 Median Prices

What Are The Value of Homes in My Suburbs? Click Here to view this FREE information.

Mar 14, 2024

Price Guide - Melbourne December 2023

Curious of Melbourne House Prices? Suburb by Suburb prices available here.